A new tax year approaches and with it new tax changes for employers to be aware of. We summarise the most important changes that take effect from April 2022 below.

Health and Social Care Levy

From 6 April 2022, there will be a temporary 1.25 percentage point increase in Class 1 (employee) and Class 4 (self-employed) national insurance contributions (NICs) paid by workers, as well as a 1.25 percentage point increase in Class 1 secondary NICs paid by employers (so 2.5% in total).

From 2023, the health and social care levy element will then be separated out and the exact amount employees pay will be visible on their pay slips. Unlike other NICs, it will be paid by all working adults, including workers over the state pension age.

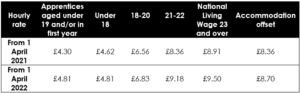

Minimum wage rates

All rates will increase from 1 April 2022 as below.

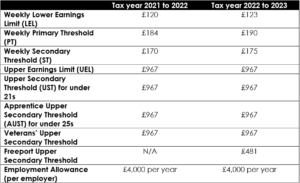

National Insurance

Employee and employer Class 1 contributions rates and thresholds (£ per week):

Company cars

Aside from wholly electric cars with zero CO2 emissions where the benefit in kind rate increases from 1% to 2% of list price on 6 April 2022, the taxable benefit in kind figures for new company cars remain as in the current tax year (2021/22) until 2024/25 inclusive.

The company car fuel multiplier increases from £24,600 to £25,300.

Contact us

If you would like to discuss any of the upcoming tax changes in the context of your own business, get in touch on 01788 539000 or 0116 261 0061 or email us at [email protected].

Read more of our blog articles by clicking here: https://www.magma.co.uk/blog